How Ecommerce Brands Actually Get Discovered In AI Search

AI search is reshaping how ecommerce brands get discovered.

One week, your products show up in ChatGPT. The next week, they’re replaced by competitors.

For many brands, this uncertainty can feel overwhelming.

Organic visibility now depends less on rankings and keywords, and more on how LLMs gather information, which platforms they rely on, and what signals help them highlight your brand.

In this guide, I’ll explain this crucial shift in detail.

I’ll unpack:

- What actually shapes visibility inside AI answers

- The business impact of compressed buyer journeys and broken attribution

- How you can build lasting relevance in this new search ecosystem

The 3 Types of AI Visibility for Ecommerce Brands

If you’re familiar with SEO, getting AI visibility is similar. It starts with how search systems decide what to display.

But for years, ecommerce SEO was a linear equation: rank = visibility = traffic (and then conversions).

AI search is changing that.

LLMs summarize, compare, and recommend products, all in one place.

In short: Shoppers can discover your products, check alternatives, and make buying decisions within AI chats.

In this new setup, brands compete across three different discovery models.

Type 1: Brand Mentions

Mentions drive product discovery and build top-of-funnel LLM visibility for your brand.

This is where your brand gets featured in AI-generated answers, often without a link to your site.

Mentions often come from reputation signals like:

- Reddit posts

- Media coverage

- User reviews

- Social discussions

Put simply, you become part of the conversation.

For new or emerging brands, this is often the first touchpoint to reach shoppers through AI.

Type 2: Citations

Citations are linked references within AI-generated results, like a footnote in an essay.

With citations, LLMs attribute specific information, claims, or data points to your pages.

Your brand becomes a source of truth in AI responses and gains credibility.

How?

When an AI tool cites your brand, it signals to shoppers that you’re an authoritative voice.

Plus, citations can support your positioning. The AI tools can pull your framing and product narrative into their response. Not someone else’s.

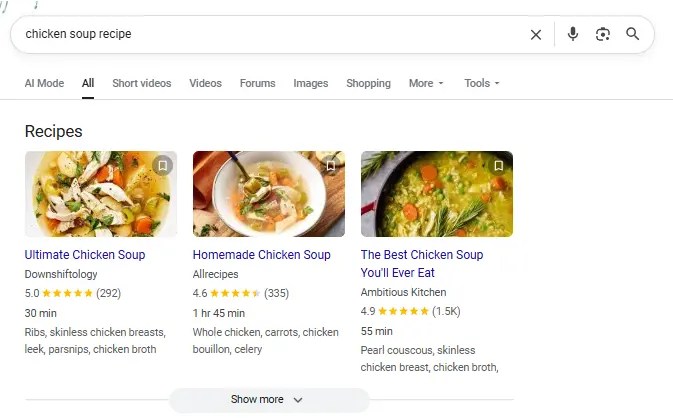

Type 3: Product Recommendations

AI platforms actively recommend products for a shopper’s specific needs and concerns.

This is the most impactful layer for ecommerce brands.

Your products can show up with pricing, ratings, and other details.

This type of visibility effectively merges discovery and purchase in one place.

This happens when the LLM reviews the query, compares options, and picks your product as the best fit.

Showing up in the list of recommended products makes your brand a part of the decision interface.

Shoppers can compare specs, prices, and reviews — or even purchase — right in the AI chatbot or search tool itself.

How AI Models Choose Which Ecommerce Brands to Surface

AI visibility as a discipline is still evolving rapidly. But there are clear patterns to which ecommerce brands get seen and which get sidelined.

Two driving forces at play are: consensus and consistency.

Consensus

With traditional search, ecommerce brands could build domain authority through activities like link building and digital PR. Strong pages from an authority perspective tended to perform well in search results.

In AI search, LLMs don’t evaluate your website and product pages in isolation. Authority is built from a consensus across sources.

LLMs ask: “What do credible sources agree on about this product?”

To decide which brands and products deserve visibility, LLMs cross-reference multiple sources, like:

- Reddit threads

- YouTube videos

- Industry reports

- Customer reviews

- Trusted publishers

- Community discussions

So, a glowing review on your PDP might mean little if customers on Amazon consistently leave 1-star ratings.

And a publisher’s feature loses impact if Reddit users repeatedly recommend your competitors instead.

In other words: No single source determines your likelihood of being mentioned or cited. It’s the pattern of consensus across multiple platforms that does this.

For example:

Keychron frequently shows up when you use AI search tools to find mechanical keyboards.

This happens because the brand has earned trust through various sources:

- Review sites like PCMag and Tom’s Guide rank Keychron in their top recommendations

- Keychron’s Amazon pages are detailed with positive reviews and an average rating of 4.4 stars

- Multiple Reddit threads in subreddits like r/MechanicalKeyboards and r/macbook recommend the brand

- Several YouTube videos feature Keychron in their roundup of mechanical keyboards

Each trust signal on its own is valuable.

But when taken together, LLMs see a pattern of independent sources validating the same brand/product for a specific use case.

Consistency

LLMs don’t crawl and rank pages the way traditional search engines do.

Instead, when answering a product-related query, an AI model might pull:

- Your product name from your Shopify store

- Pricing from Google Merchant Center

- Key specs from Amazon

- Opinions from users on Reddit

If your product title is “stainless steel” on Amazon but “brushed metal” on Walmart, the LLM can’t decide which is correct. This inconsistency could make the AI tool less likely to include any information about your product. Or it could include the wrong information.

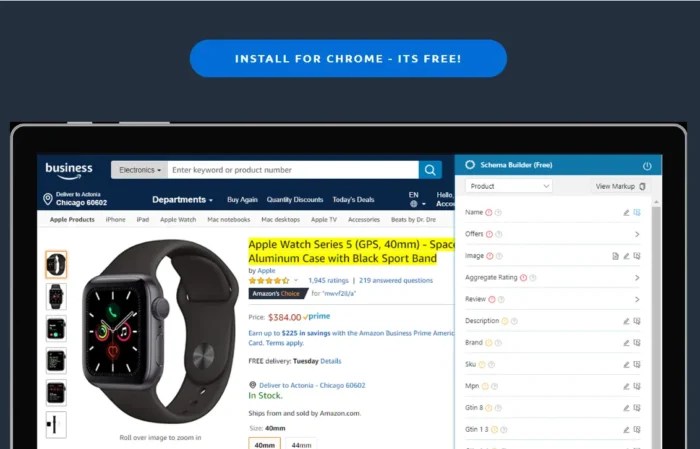

This is why data hygiene is crucial for building AI visibility.

You need to maintain a clean, synchronized identity for every product across every channel.

Your product attributes should follow the same pattern across your site, marketplaces, and feeds:

- Model numbers

- Dimensions

- Materials

- Weights

- Prices

LLMs use these data points to match your products to queries and validate claims across sources.

Your Amazon listing, your Shopify store, your Google Merchant feed — all sources need to tell the same story with the same data.

So, the same SKU name, image, and product description should appear everywhere your product appears.

Finally, outdated data signals decay, and models may deprioritize products with outdated info.

When you change a price or update a key spec, that change should be visible everywhere. Stock availability, pricing, and features should always be up to date.

Types of Content That Dominate Ecommerce AI Search

We’re seeing clear patterns in what gets cited, mentioned, or ignored in AI search for ecommerce.

Understanding these patterns can be the difference between hoping you show up and knowing how to position your brand so that you do show up.

Here’s what’s currently doing well in AI search for ecommerce:

Top Cited Sources

I wanted to see which brands are cited most frequently in LLM responses for ecommerce queries — so I tested it.

I picked nine popular ecommerce niches and searched category-specific queries across ChatGPT, Claude, Perplexity, and AI Mode.

Based on the responses, I made a list of five popular brands showing up frequently for each vertical.

Then, I jumped to the “Competitor Research” tab in Semrush’s AI Visibility Toolkit to run a gap analysis for these five brands in each category.

The “Sources” tab showed which domains LLMs cite most frequently, like this for the “outdoor travel & gear” niche:

This data reveals where LLMs pull product information, and which platforms matter most in your vertical.

Here’s what this data tells you:

- Reddit: Reddit is a top-cited source for nearly every industry. If people aren’t discussing your brand in relevant subreddits, invest in Reddit marketing.

- YouTube: It’s another universal citation source. Video content from creators and users feeds into AI answers. That means having a YouTube presence can be a huge visibility lever for most ecommerce verticals.

- Category-specific platforms: Generic sources like Amazon appear everywhere. But niche platforms (like Petco, Barbend, Sephora) carry weight in their verticals.

- Wikipedia: It’s a top source for categories like outdoor gear, healthy drinks, and gadgets. This is where product context and category education matter a lot alongside the likes of specs and pricing.

Going beyond these top-cited platforms, here are the kinds of content LLMs link to most frequently for ecommerce queries:

Publisher Listicles

These are product roundups, buying guides, and comparison posts from established media outlets.

For example, I asked ChatGPT for the best Bluetooth speaker recommendations.

It cites publishers like TechRadar, Rtings.com, and Stereo Guide for this response.

Getting featured in these listicles means you’re part of the source material LLMs use to compile information.

AI models use publisher listicles as sources because they:

- Compare multiple products in one place

- Refresh their recommendations periodically, providing recency signals

- Include specific, comparable details like price ranges, key specs, and pros/cons lists

- Fulfill high editorial standards and so may appear more trustworthy than user-generated content

Retailer Product Pages

Retailers like Amazon, Walmart, and Target are among the most frequently cited sources for product queries.

When I asked Perplexity about the NutriBullet Turbo, it cited the product pages from the likes of Walmart and Macy’s.

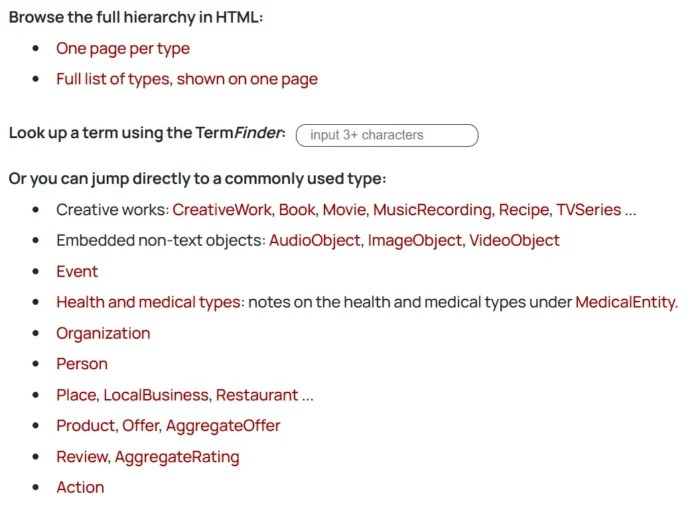

These PDPs provide structured data points like ratings, pricing, and key specs.

AI models often rely on these product pages because they:

- Include structured, machine-readable product data like specs, dimensions, materials, and pricing

- Aggregate hundreds or thousands of customer reviews as social proof

- Show real-time availability and pricing

Lab Tests and Expert Reviews

In-depth product testing content from experts is another important source for citations.

These websites test products systematically and publish detailed findings.

LLMs can then use this empirical data as the basis for their responses.

For example, I asked Claude to find the best mattress for side sleepers.

The tool references sites like NapLab, Consumer Reports, and Sleep Foundation for data-backed recommendations.

AI models consider lab test or expert review content for citations because they:

- Compare products against consistent criteria and benchmarks

- Show credibility with independent, systematic evaluation processes

- Include measurable data to explain their top-ranked recommendations

- Periodically update their recommendations to offer fresh, authoritative data

Reddit Threads and Community Discussions

Conversations on Reddit, Facebook groups, and YouTube comments frequently appear in AI responses.

This is especially true for subjective queries like “Is X worth it?” or “What do people actually think about Y?”

I tested this myself by asking Perplexity whether the Instant Pot Duo is worth buying.

It pulled insights from multiple Reddit threads, a Facebook group, and a YouTube video to respond based on real user input.

Brands that get mentioned positively across multiple Reddit threads build “cultural proof.”

And those organic discussions about your brand feed directly into AI training data and real-time search results.

AI models pull from these communities because they:

- Present an aggregated sentiment from community discussions

- Contain contrasting opinions and insights to objectively review products

- Show different use cases and pain points that a product can tackle

- Highlight a product’s pros and cons based on firsthand experience

Comparison Posts

Content that compares two or more products can also help LLMs find the right brands to mention in their response.

When I ask AI Mode for alternatives to the supplement brand Athletic Greens, it mentions five options.

The sources include several comparison articles (alongside some roundups).

Being included in this type of content (even if you’re not the winner) can help build your visibility.

This could be Brand A vs. Brand B blog posts, YouTube videos, review sites, and social media discussions.

AI models refer to these resources because they:

- Answer buyers’ questions by comparing two or more products

- Focus on decision-making criteria and help people make informed decisions

What This Shift Means for Your Ecommerce Brand

Let’s now consider the business impact of this AI search setup for your ecommerce brand.

The Compressed Buyer Journey

The traditional ecommerce funnel was built on multiple touchpoints.

A shopper might:

- Google a product category

- Read reviews on multiple different sites

- Check Reddit and YouTube

- Visit brand websites to compare prices

- Return days later to buy

Each step was an opportunity for your brand to show up, make an impression, and win their trust.

For a lot of purchase decisions, AI search collapses this entire journey into a single interaction.

The same shoppers can now go to AI tools and ask, “What’s the best air fryer for a small kitchen?”

They get a single response with buying criteria, product recommendations, pricing, ratings, and more.

Now, clearly this isn’t going to happen for every purchase decision. These tools are still new for one thing, and it takes a lot to majorly shift buyer behavior. (And of course, SEO is not dead.)

But discovery, evaluation, and consideration CAN all happen in one response now. The AI agent performs the research labor.

That means you have fewer chances to influence buyers.

In the past, if a shopper didn’t discover you in organic search, they might find you through a review site, a Reddit thread, or a retargeting ad.

In other words: You could lose the first touchpoint and still win the sale three touchpoints later.

With AI search, you might only get one shot: the initial response.

For many ecommerce queries, AI tools give you a curated list of options. If you’re not in that initial answer, you don’t exist in the decision process.

As AI platforms make it easy for shoppers to buy directly within the chat, you often won’t get a second chance.

Take action: Build an AI search strategy using our Seen & Trusted Brand Framework to increase the probability of your brand getting featured in AI responses.

The Visibility Paradox

Your brand might frequently show up in AI search. But your analytics show flat traffic and zero conversions traced back to AI tools.

Here’s why:

Not all AI visibility is created equal.

Your brand can appear in 10 different AI responses and drive 10 completely different business outcomes.

It all depends on how you’re presented.

Here’s what the visibility spectrum actually looks like for ecommerce brands:

| Visibility Type | Example | Business Outcome |

|---|---|---|

| Mentioned without context | “Popular air fryer brands include Ninja, Cosori, Instant Pot, and Philips.” | Value: Brand awareness Purchase Likelihood: Low |

| Mentioned with attributes | “Cosori is known for its large capacity and intuitive controls.” | Value: Stronger positioning Purchase Likelihood: Low-Medium |

| Cited as source | “According to Cosori’s specifications, the air fryer’s temperature range is 170-400°F and includes a 2-year warranty.” | Value: Credibility + potential traffic Purchase Likelihood: Medium-High |

| Recommended | “The Cosori 5.8-quart model includes 11 presets, uses 85% less oil than deep frying, fits a 3-pound chicken, and costs around $120.” | Value: Active consideration and purchase Purchase Likelihood: High |

That means getting mentioned is table stakes, not the end goal.

Building brand awareness without differentiation just makes you a part of the crowd.

To drive real sales, you need to earn citations and product recommendations.

The brands winning in AI search are:

- Cited as trustworthy sources

- Recommended for specific use cases

Attribution Gets Murky

When shoppers find products through AI but buy elsewhere, analytics tools can’t track the whole journey.

This creates two problems:

- You can’t prove the ROI of AI search: Even if AI mentions are driving consideration, you’ll get zero or limited data on that. You won’t see the prompt the user asked or the response from the tool.

- You can’t optimize what you can’t measure: When you don’t know how people are discovering you in AI answers, you can’t A/B test your way to better visibility. The feedback loop is broken.

Tools like Semrush’s AI SEO Toolkit are closing this gap by showing how your brand and competitors appear in AI search.

I used the tool to check the AI visibility and search performance for Vuori, an athleisure brand.

The brand has a score of 76 against the industry average of 82, and is frequently mentioned AND cited in AI responses.

The toolkit also identifies specific prompts where your brand is mentioned or missing.

This makes it easy to spot exactly which type of queries are driving visibility and which represent missed opportunities.

For example, here’s a list of prompts where LLMs don’t feature Vuori, but do mention its competitors.

Go to the “Cited Sources” tab to find out the websites that LLMs most commonly refer to for your industry-related queries.

For Vuori, it’s sites like Reddit, Men’s Health, Forbes, and more.

The “Source Opportunities” tab will give you a list of key sites that mention your competitors, but not you. These are sites you should aim to get your brand included on.

Besides tracking your own AI visibility, the AI SEO Toolkit also lets you monitor your competitors’ performance on AI platforms.

The “Competitor Research” report compares you to your biggest competitors in terms of overall AI visibility.

It also highlights topics and prompts where other brands are featured, but you aren’t.

Learn more about how these tools can help you boost your visibility with our full Semrush AI SEO Toolkit guide.

Example of a Brand That’s Winning in AI Search: Caraway

If you want to see what winning in AI search actually looks like, look at the cookware brand, Caraway.

When you ask AI about the “best bakeware set” or the “best ceramic pans,” Caraway almost always makes the shortlist.

Data from Semrush’s AI SEO Toolkit shows that Caraway also outweighs its biggest competitors in AI visibility.

Let’s break down how Caraway built this advantage.

Showing Up Where LLMs Look

Caraway is frequently featured on publishers like Taste of Home, Good Housekeeping, and Food and Wine.

These are the actual sources LLMs cite when constructing answers about cookware-related queries.

For example, here’s a paragraph from the Food and Wine article ChatGPT cited as a source, which mentions the attributes ChatGPT used in its recommendation:

Caraway also earns mentions through organic discussions on Reddit, Quora, and kitchen forums.

Retailer Evidence That AI Can Cite

Caraway’s clean Amazon Brand Store and on-site product pages also make it easily citable.

These product listings and pages give LLMs concrete signals like:

- Multiple in-stock SKUs with visible sales velocity (“500+ bought in the past month”)

- Product rating and volume

- Rich media files

These retailer PDPs become credible sources for verifying pricing, availability, or product specs.

Strong Affiliate Presence

Caraway also runs an affiliate program, and the brand makes it frictionless for publishers to feature its products through:

- Affiliate networks: Links are available through major networks like Skimlinks and Sovrn/Commerce

- Amazon compatibility: Editors can also use Amazon Associates links for Caraway’s stocked SKUs

- Affiliate-safe pages: Product detail pages feature clean URLs, consistent pricing, and stock availability

- Reviewer support: The brand provides an affiliate kit, including link types, banner ads, text links, and email copy

This all makes it easy for Caraway to work with influencers and other publishers to promote its products. And these publishers can then appear as citations when AI tools make their recommendations.

For example, all the highlighted sources in the ChatGPT conversation below contain Caraway affiliate links:

Part of the Category Narrative

Many style media and mainstream outlets reference Caraway in their content.

Here’s a recent example from an Architectural Digest interview featuring the cookware set as an essential kitchen item.

This creates more authority for the brand in the cookware and kitchen category.

Make AI Work for Your Ecommerce Brand

You now know how the game works and who’s winning. It’s your turn to play it.

But there’s a lot to do.

Making your site readable by LLMs, opmtimizing your structured data, and setting up automated product feeds are just stratching the surface.

Our comprehensive Ecommerce AIO Guide gives you alll of the actionable tactics to consistently show up in AI results.

The post How Ecommerce Brands Actually Get Discovered In AI Search appeared first on Backlinko.

Read more at Read More